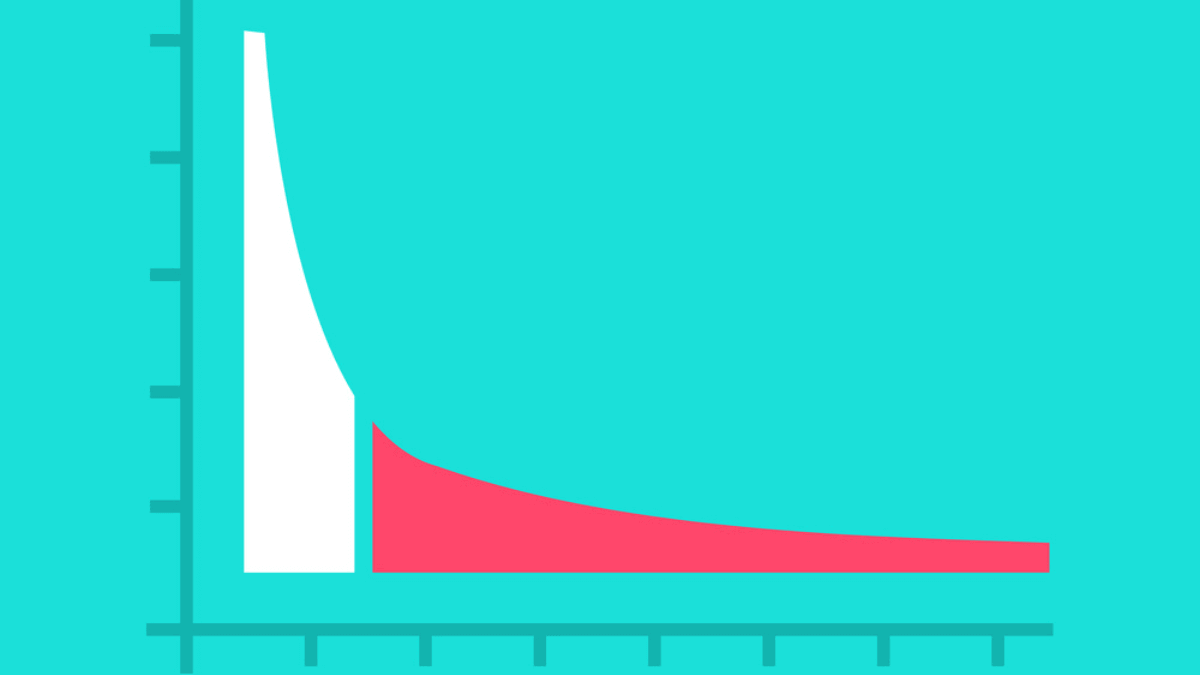

In statistics, a long tail of some distributions of numbers is the portion of the distribution having a large number of occurrences far from the “head” or central part of the distribution. The distribution could involve popularities, random numbers of occurrences of events with various probabilities, etc. A probability distribution is said to have a long tail if a larger share of population rests within its tail than would under a normal distribution.

A long-tail distribution will arise with the inclusion of many values unusually far from the mean, which increase the magnitude of the skewness of the distribution. A long-tailed distribution is a particular type of heavy-tailed distribution. The term long tail has gained popularity in recent times as describing the retailing strategy of selling a large number of unique items with relatively small quantities sold of each—usually in addition to selling fewer popular items in large quantities.

The long tail was popularized by Chris Anderson in an October 2004 Wired magazine article, in which he mentioned Amazon.com, Apple and Yahoo! as examples of businesses applying this strategy. Anderson elaborated the concept in his book The Long Tail: Why the Future of Business Is Selling Less of More.

The distribution and inventory costs of businesses successfully applying this strategy allow them to realize significant profit out of selling small volumes of hard-to-find items to many customers instead of only selling large volumes of a reduced number of popular items. The total sales of this large number of “non-hit items” is called “the long tail”.

Given enough choice, a large population of customers, and negligible stocking and distribution costs, the selection and buying pattern of the population results in the demand across products having a power law distribution or Pareto distribution. It is important to understand why some distributions are normal vs. long tail (power) distributions. Chris Anderson argues that while quantities such as human height or IQ follow a normal distribution, in scale-free networks with preferential attachments, power law distributions are created, i.e. because some nodes are more connected than others (like Malcolm Gladwell’s “mavens” in The Tipping Point).

The long tail concept has found some ground for application, research, and experimentation. It is a term used in online business, mass media, micro-finance (Grameen Bank, for example), user-driven innovation (Eric von Hippel), and social network mechanisms (e.g. crowdsourcing, crowdcasting, peer-to-peer), economic models, and marketing (viral marketing). A frequency distribution with a long tail has been studied by statisticians since at least 1946. The term has also been used in the finance and insurance business for many years. The work of Benoît Mandelbrot in the 1950s and later has led to him being referred to as “the father of long tails”.