Beyond Search: The Agentic Funnel Powered by the Shopping Graph

Discover how the agentic funnel changes the shopping experience and transforms how your team organizes and works.

Google just collapsed the entire e-commerce funnel into a single agentic interaction. While the industry obsesses over whether Google or OpenAI will “win” AI search, they’re missing the real story: the shopping graph is becoming the new sitemap, and retailers without one are about to become invisible.

The Funnel is Dying, Long Live the Agent

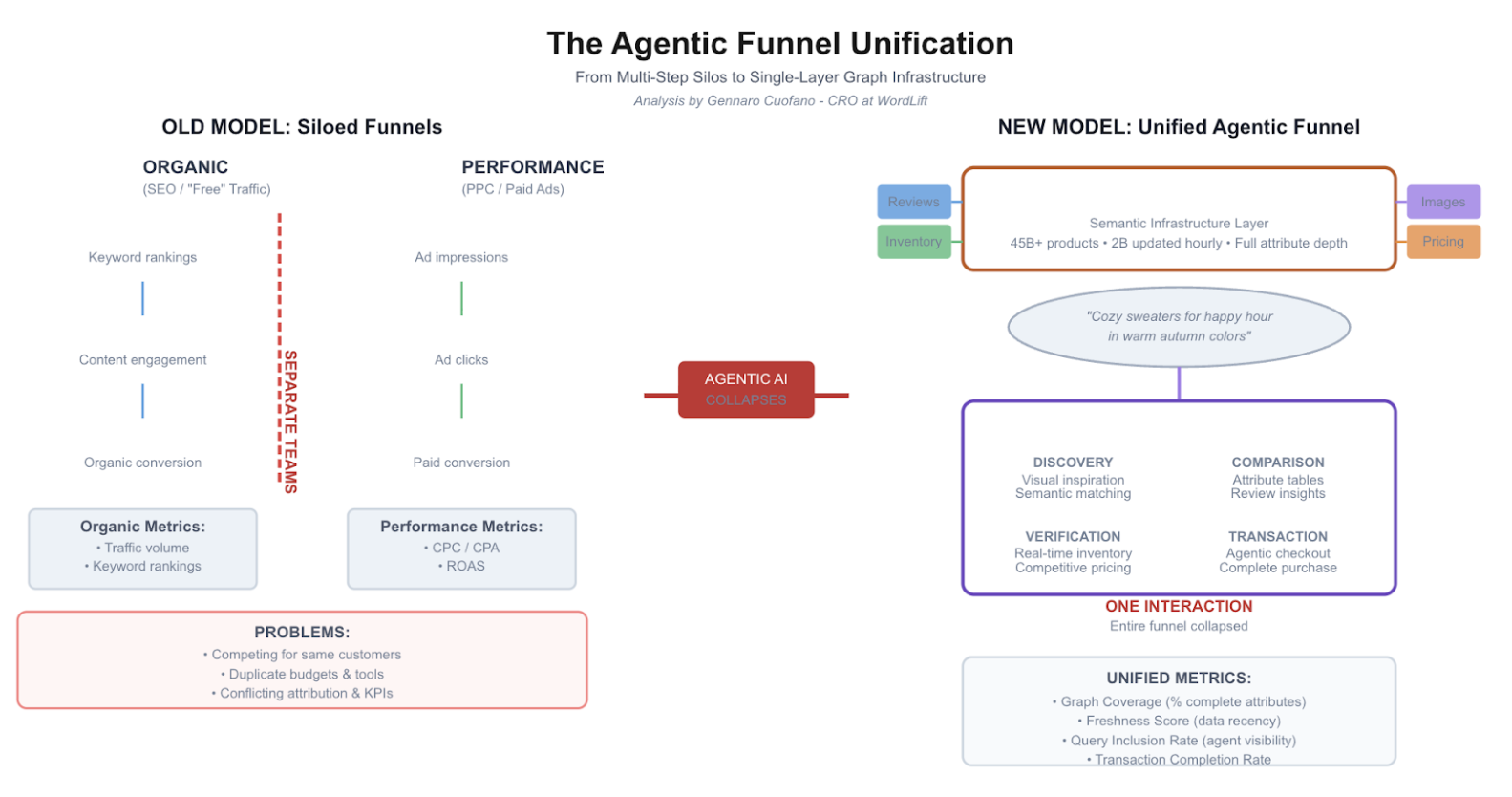

For decades, we optimized for a multi-step funnel: awareness → consideration → purchase. Each step required friction—clicks, tabs, comparisons, tracking. We built entire industries around managing this friction: comparison sites, affiliate networks, retargeting campaigns, abandoned cart recovery.

Google’s announcement doesn’t just optimize this funnel. It eliminates it.

When a user asks “cozy sweaters for happy hour in warm autumn colors,” the AI doesn’t send them to step one of a funnel. It completes the entire journey in a single response: discovery, comparison, inventory check, price verification, and now—with agentic checkout—the actual purchase. The funnel collapsed from five steps across multiple sessions to one conversational exchange.

This isn’t e-commerce evolution. It’s a phase change.

The Google vs. OpenAI Acceleration Trap

The narrative says this is about Google defending search against ChatGPT’s SearchGPT. But that framing misses the structural transformation underneath.

Both companies are racing toward the same end state: agentic commerce layers that sit between consumers and retailers. Google has the Shopping Graph with 45+ billion product listings, 2 billion updated hourly. OpenAI has partnerships with Shopify, Instacart, and is building toward similar infrastructure.

The competition isn’t about who builds the better chatbot. It’s about who becomes the mandatory intermediary in the new agentic economy. And that intermediary position is worth trillions—because it owns the data, the context, and increasingly, the transaction itself.

Every retailer celebrating “another channel” is missing that this isn’t a channel. It’s a replacement of the entire discovery and transaction layer they used to control.

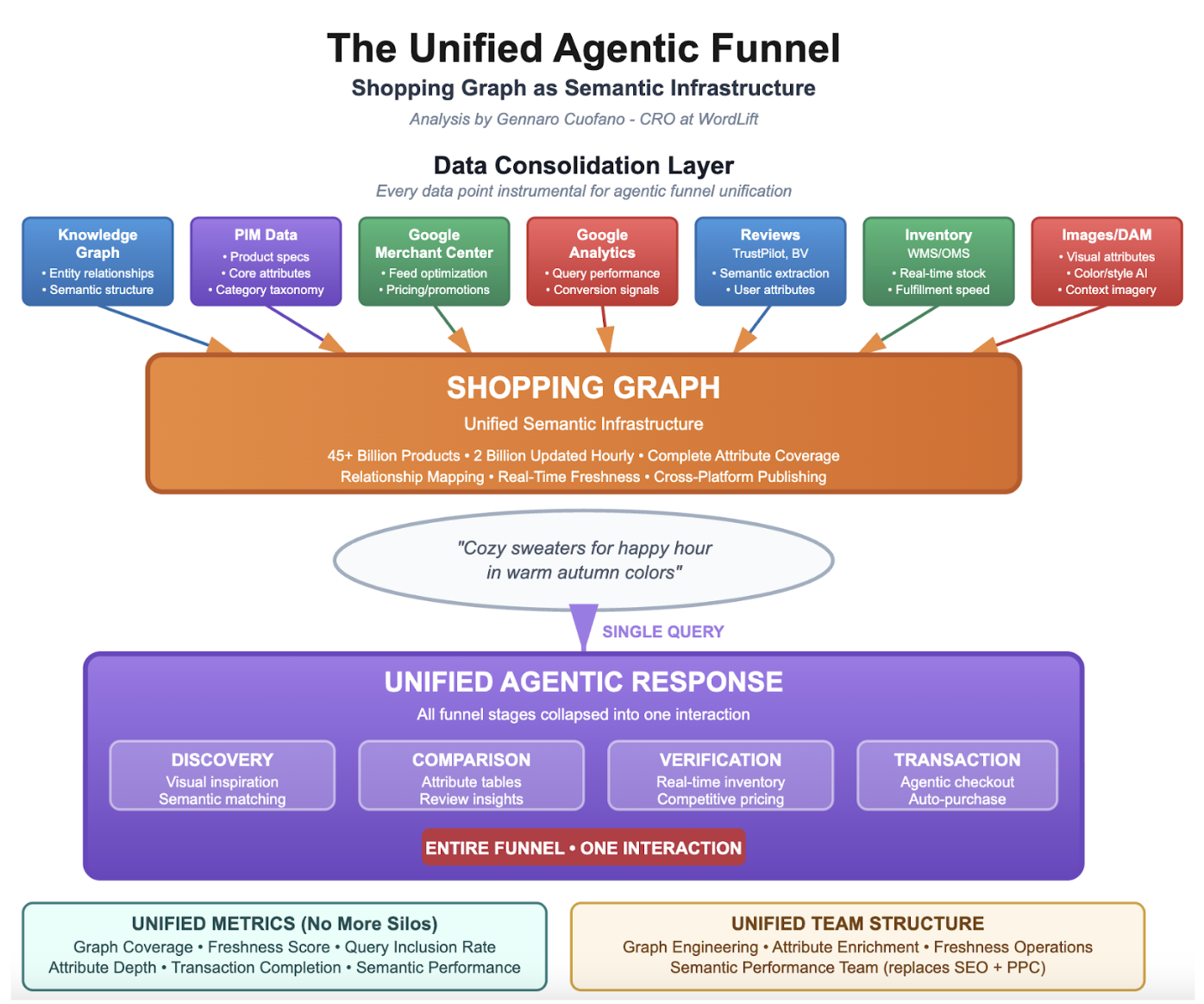

The Shopping Graph: Your New AI Sitemap

Here’s what Google’s Shopping Graph actually represents: 45 billion product listings with 2 billion updated every hour, structured with attributes, relationships, inventory status, pricing, reviews, and images, all connected to merchant systems for real-time transaction capability.

This isn’t a product database. It’s a live semantic infrastructure that makes products discoverable, comparable, and purchasable within agentic workflows.

For twenty years, your XML sitemap told Google’s crawler what pages to index. You optimized it obsessively because discoverability depended on it.

Your shopping graph is now your AI sitemap. It’s the structured semantic layer that tells AI agents what you sell, how it compares, what’s in stock, and how to buy it. Without this layer, you don’t exist in agentic commerce—not because you’re ranked poorly, but because you’re not queryable at all.

The End of the Organic vs. Performance Divide

Here’s the structural shift nobody’s talking about: the shopping graph doesn’t just unify the customer funnel—it unifies your entire marketing organization.

For fifteen years, we’ve run marketing in silos. The organic team handled SEO, content, rankings, “free” traffic, long-term brand building, with months to see results. The performance team managed PPC, Shopping Ads, immediate attribution, direct ROI, daily optimization. Different KPIs. Different budgets. Different platforms. Often, different agencies. Sometimes, actively competing for the same customer.

The agentic funnel destroys this division completely.

Why the Silos Collapse

When Google’s AI Mode answers “cozy sweaters for happy hour in warm autumn colors,” it’s not running two separate processes—one for organic results and another for ad placements. Instead, it queries the Shopping Graph once and constructs a unified response that includes product discovery (formerly organic), visual inspiration (formerly organic content plus Shopping ads), comparison tables (formerly organic reviews plus paid product listings), inventory verification (formerly merchant feeds), price tracking (formerly performance campaigns), and transaction completion (formerly conversion tracking across both channels).

There is no organic result versus paid result. There’s only: are you in the graph with sufficient semantic depth to be included in the agentic response?

The New Unified Layer: Graph Presence

What determines whether you appear in that AI Mode response isn’t your organic ranking or your bid strategy. It’s your shopping graph completeness score. Do you have the structured attributes the query requires? For “cozy,” that means texture data. For “warm autumn colors,” that means color taxonomy. Is your inventory data fresh with real-time sync, not daily batch updates? Are your reviews semantically parsed so “feels soft” is extracted as a texture attribute? Do your product images match the visual query with AI-readable image attributes? Is your pricing competitive within the graph through comparative data, not absolute numbers? Can the transaction complete through API integration and payment infrastructure?

This is neither organic nor performance. It’s semantic infrastructure.

Your old organic team optimized content and links. Your old performance team optimized bids and audiences. Your new unified team optimizes graph completeness—and that completeness determines visibility across what used to be separate channels.

The Practical Playbook: Building Your Shopping Graph

Most strategy pieces stop at “build your shopping graph.” That’s useless. Here’s the actual work.

Phase 1: Data Consolidation Architecture

Your shopping graph isn’t a new database. It’s a semantic unification layer that consolidates fragmented data sources you already have but never properly connected.

Map every system that contains product truth. Your PIM and ERP hold SKUs, variants, specifications, category hierarchies, and pricing structures—currently structured but semantically shallow, needing relationship mapping and attribute enrichment. Your warehouse management and order management systems contain real-time stock levels, warehouse locations, and fulfillment speed—currently updating every 15-60 minutes but requiring hourly minimum or continuous sync for the graph.

Customer reviews are where most retailers miss the biggest opportunity. Your reviews from Yotpo, Bazaarvoice, or native platforms contain star ratings, review text, dates, verification status, and customer-uploaded images. Currently they’re siloed in the review platform, rarely integrated. But here’s what changes everything: reviews aren’t just social proof—they’re unsolicited attribute labeling by actual users.

When a customer writes “this moisturizer absorbs quickly without feeling greasy,” they’ve just provided three critical data points: absorption speed attribute marked as fast, texture attribute marked as non-greasy, and use case validation for those avoiding greasy products. Your shopping graph needs to extract these attributes programmatically and attach them to the product entity. When an AI agent queries “moisturizer that absorbs fast for oily skin,” your product becomes discoverable through review-derived attributes, not just your marketing copy.

Brand guidelines and product content live in your DAM or content management systems, disconnected from product data. They contain marketing descriptions, brand positioning, usage instructions, and care instructions that need semantic tagging for attribute extraction. Your merchant feeds for Google Shopping, Meta, and Amazon hold optimized product titles, category mappings, and promotional pricing—manually maintained and often inconsistent across platforms when they should flow from a single source of truth.

Performance data from Google Ads and Analytics shows which products convert for which queries, seasonal demand patterns, and price sensitivity signals. Currently used only for bid optimization, this data should feed semantic attribute prioritization in your graph. Your image assets in DAM or CDN contain product photography, lifestyle imagery, and video content organized by SKU with only filename metadata, when they need AI-readable visual attributes covering color, style, context, and use case.

The Consolidation Challenge

You don’t need all this data in one database. You need it semantically unified and queryable as a single knowledge structure.

The old model had each system maintaining its data and exporting feeds to marketing platforms. PIM fed the website, inventory fed the Google Shopping Feed, reviews powered an on-site widget, images sat in the CDN. No connections between systems.

The shopping graph model creates a central semantic layer that references distributed systems in real-time. Each product entity connects PIM data with inventory status, review attributes, image metadata, and performance signals. A query against the entity returns a unified, fresh, semantically enriched response. A single update propagates across all downstream uses.

Phase 2: Semantic Enrichment Process

Raw data isn’t enough. The graph needs semantic depth.

Attribute extraction from reviews delivers the highest ROI as a quick win. Deploy NLP extraction on your review corpus to identify material properties like “soft,” “breathable,” “durable,” and “stretchy.” Extract fit characteristics including “runs small,” “true to size,” and “generous cut.” Capture use case validation such as “perfect for travel” and “works for sensitive skin.” Pull out comparative statements like “better than [competitor]” and problem-solving mentions such as “solved my [problem]” or “doesn’t [negative attribute].”

Attach these as structured attributes to product entities. Now when an agent queries “travel-friendly backpack that fits under airplane seats,” your product is discoverable because 47 reviews mentioned “perfect for travel” and 23 mentioned “fits under seat.” This isn’t sentiment analysis. It’s semantic attribute extraction that makes unstructured review text queryable by AI agents.

Your marketing copy contains semantic attributes you’ve never structured. When your description reads “This cozy sweater features a relaxed fit in warm autumn tones, perfect for casual evening gatherings,” you need to extract and structure texture as cozy, fit as relaxed, color family as warm autumn tones, occasion as casual evening and social gatherings, formality level as casual, and season suggestion as fall and autumn.

Use vision AI on your images to extract dominant colors with both hex codes and semantic color names, style attributes like modern, vintage, minimalist, or bohemian, context showing indoor or outdoor and casual or formal settings, and composition types such as close-up, lifestyle, model-worn, or flat lay. This makes your products discoverable for visual queries like “show me minimalist fall sweaters in rust tones.”

Relationship Mapping

Products don’t exist in isolation. The graph needs explicit relationships that agents can traverse. Compatibility relationships connect items that work together—phone cases to specific phone models, printers to ink cartridge models, camera lenses to camera body types. Similarity relationships map alternatives within the same category but different brands, same price range with different features, or same use case with different styles. Complementary relationships show what pairs well together, completes the look, or what customers also need—shirts with pants and shoes, shampoo with conditioner, cameras with memory cards and bags. Hierarchy relationships define variants, collection membership, and availability—products to size variants, color options, and seasonal versions.

These relationships make your products discoverable through associative queries: “what goes with the backpack I bought last week?”

Taxonomy Standardization

Your internal category names don’t match how agents query. You say “Women’s Apparel > Tops > Knits > Pullovers” while agents query “cozy sweaters,” “warm layers,” and “casual tops.” Map your taxonomy to Schema.org types for standard semantic web vocabulary, Google Product Categories for Shopping Graph integration requirements, natural language query patterns from search console data, and competitive category positioning that shows how you differentiate.

Phase 3: Real-Time Infrastructure

Batch updates are dead. Agentic commerce requires continuous freshness.

Google updates 2 billion listings hourly. Your graph needs comparable freshness. Minimum viable is hourly inventory sync covering stock level changes, new arrivals, and discontinued items. Competitive standard is 15-minute sync for high-velocity products, limited inventory items, and flash sales. Optimal is near-real-time event-driven updates with webhook triggers on inventory changes, transaction-level updates, and cross-warehouse visibility.

Why this matters: an agent showing out-of-stock items creates failed transactions and lost trust. The agent will deprioritize your products in future queries.

Agentic checkout requires accurate pricing. For static pricing, implement hourly verification minimum. Dynamic pricing demands real-time API access. Promotional pricing needs event-driven updates when promos activate or expire. Include in your graph the current price, original price if on sale, price history for price-drop tracking, promotional conditions like minimum quantity or member-only restrictions, and price comparison data showing your price versus market.

New reviews add new semantic attributes and need immediate processing. Trigger semantic extraction on new review submission, update product entity attributes within one hour, recalculate attribute confidence scores since more reviews mean higher confidence, and flag newly emerged attributes for priority. A product that suddenly gets 10 reviews mentioning “perfect for working from home” as a new use case should surface for WFH-related queries immediately, not after next month’s batch update.

Phase 4: Multi-Platform Graph Publishing

Your shopping graph isn’t internal infrastructure. It’s a publishing layer that makes your products accessible across agentic platforms.

Deploy comprehensive Schema.org structured data markup on all product pages. Minimum required includes product type, name, description, image, price, availability, brand, and SKU. Competitive standard adds AggregateRating from reviews, review snippets, product variants, shipping details, and return policy. Optimal implementation is where most retailers fail—add custom properties for your key differentiators, relationship markup using isRelatedTo and isAccessoryFor, use case and occasion properties, material and sustainability attributes, and size/fit guidance structured data.

For Google Shopping Graph integration, your current Merchant Center feed probably has 20-30 attributes. The shopping graph can use 100+. Add custom_label_0 through custom_label_4 for semantic segmentation, product_detail for attribute pairs like “Material: Organic Cotton,” product_highlight for key features extracted from reviews, lifestyle_image_link for context imagery, size_system and size_type for structured fit data, plus refined targeting through age_group, gender, and color attributes. Implement the Content API for Shopping for real-time inventory and price updates, Local Inventory Ads for store-level stock, and Merchant Promotions for structured promo data.

Build your own API layer for direct agent access. Create a product query API that accepts semantic queries in natural language, structured attribute filters, inventory location for local stock, price range parameters, and sort by relevance. This returns enriched product entities with full graph data. This lets you negotiate integration terms with emerging agentic platforms rather than accepting their default data extraction.

Phase 5: Continuous Optimization (Ongoing)

The shopping graph isn’t a project. It’s infrastructure that requires continuous refinement.

Monthly semantic gap analysis should audit which queries return competitors but not your products, which attributes competitors have that you lack, which new use cases are emerging in reviews and queries, and which seasonal attributes need activation or deactivation.

Here’s where organic and performance truly merge in attribution. The old model had organic using last-click session-based attribution and performance using multi-touch within ad platforms, with no connection between them. Graph attribution tracks which semantic attributes drove discovery, measures graph completeness impact on visibility, correlates attribute enrichment to conversion, and provides a unified view: graph presence leads to agent inclusion leads to transaction.

You’re no longer measuring “organic traffic” versus “paid traffic.” You’re measuring graph performance through semantic completeness, freshness score, relationship coverage, and attribute confidence. Your optimization shifts from “improve rankings” or “lower CPA” to “increase graph queryability across intent patterns.”

Connect performance data back to graph enrichment through feedback loops. When high-converting queries emerge like “moisturizer for sensitive skin under $30,” ensure “sensitive skin” becomes a structured attribute, price range stays accurate and competitive, and related products have “suitable for sensitive skin” attributes extracted from reviews. When agentic checkout fails because inventory data was stale, price had changed, or product was discontinued, fix sync issues immediately. When you lose to competitors in agent responses, analyze their structured data, identify missing attributes, and enhance your graph depth in those dimensions.

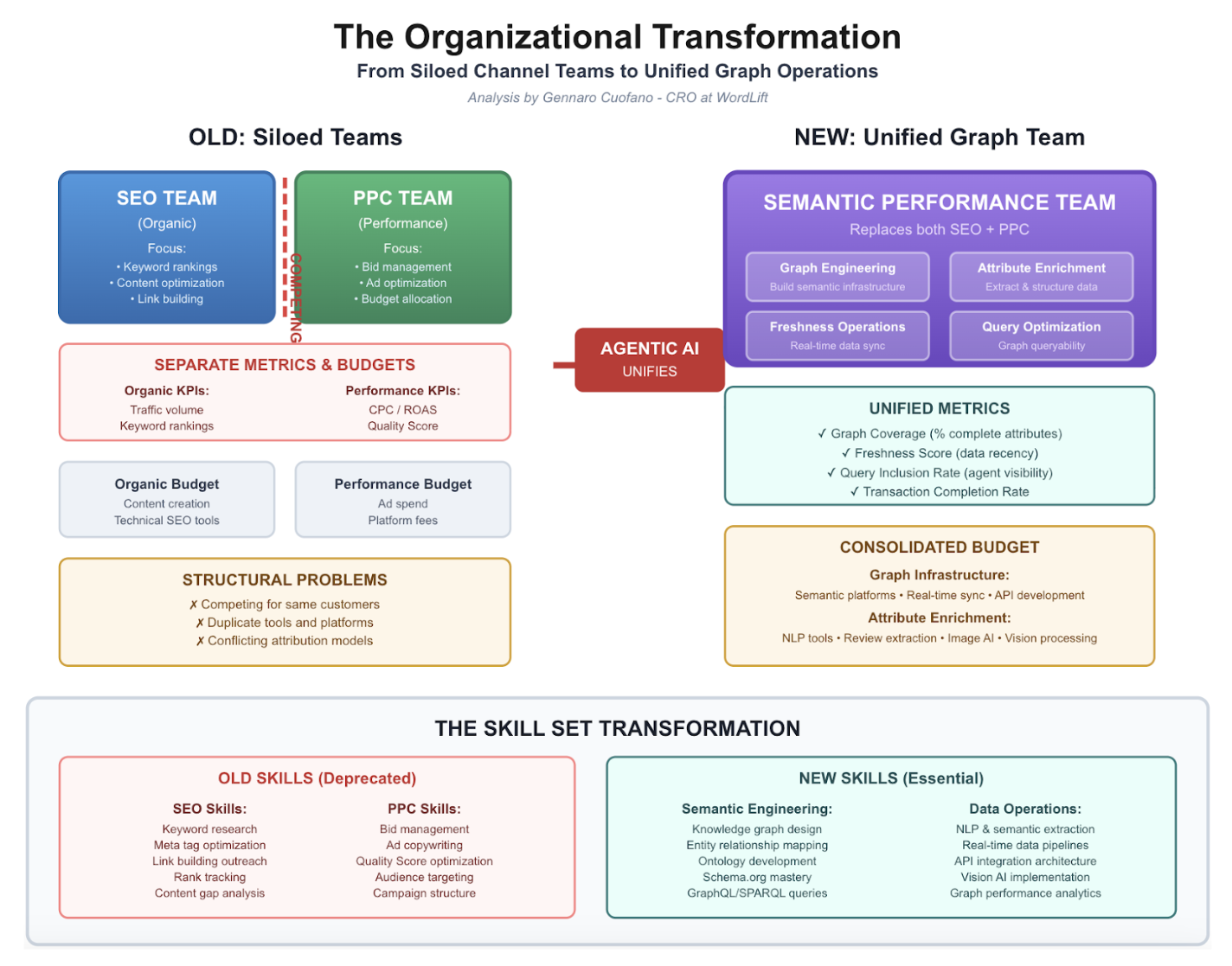

The Organizational Transformation

This isn’t just technical infrastructure. It requires organizational restructuring.

The End of Channel Teams

You can’t have separate teams optimizing for “organic” and “performance” when there’s a single shopping graph determining visibility across both.

The old structure had an SEO team focused on organic rankings, a PPC team managing ad campaigns, a content team creating product descriptions and blog posts, and an analytics team reporting in silos. The new structure needs a Graph Engineering Team building and maintaining semantic infrastructure, an Attribute Enrichment Team extracting and structuring data from reviews, content, and images, a Freshness Operations Team ensuring real-time data sync, and a Semantic Performance Team optimizing graph queryability across intent patterns.

The skill sets shift from “keyword research” and “bid management” to semantic engineering and knowledge graph operations.

The Budget Unification

When organic and performance collapse into graph presence, so do the budgets.

The old model split organic budget across content, technical SEO, and link building while performance budget covered ad spend and platform fees, measured separately and often competing for resources. The new model consolidates into a graph infrastructure budget for semantic platforms, real-time sync, and API development; attribute enrichment budget for NLP tools, review extraction, and image AI; and platform integration budget for connection fees and transaction costs across Google, OpenAI, and emerging platforms.

ROI is measured as graph completeness impact on total commerce revenue, not channel-specific attribution.

The Metrics Shift

Deprecated metrics include organic traffic volume, organic keyword rankings, ad impression share, cost per click, and channel-specific conversion rate. These metrics made sense when organic and performance were separate funnels. They’re meaningless when there’s one agentic interaction.

New core metrics track Graph Coverage as the percentage of inventory with complete semantic attributes, Freshness Score as the average age of critical data like inventory, pricing, and reviews, and Attribute Depth showing average structured attributes per product versus category benchmarks. Measure Relationship Density as the percentage of products with mapped complementary and similar items, Query Inclusion Rate as your percentage appearance in relevant agentic responses when you should appear, Transaction Completion Rate as the percentage of agent-initiated purchases that successfully complete, and Semantic Performance Index as a composite score of graph quality metrics.

These metrics apply across all agentic platforms—Google, OpenAI, future entrants—not per-channel.

The Strategic Implications

Graph Completeness Becomes Competitive Moat

In the old world, you could compete with limited resources. A small content budget meant focusing on long-tail keywords. A small ad budget meant targeting specific high-intent queries. Niche positioning meant owning specific categories.

In the agentic world, incomplete graphs get excluded from queries entirely. There’s no “ranking position #7” where you still get some traffic. You’re either in the agentic response because your graph has the required semantic depth, or you don’t exist. The barrier to entry isn’t capital—it’s semantic infrastructure.

A well-funded competitor with poor graph architecture loses to a smaller player with superior semantic depth. Graph completeness is defensible because it requires operational excellence across data consolidation, continuous enrichment, real-time sync, and cross-system integration. It’s not something you can outsource to an agency or buy with ad spend.

The Platform Leverage Inversion

For twenty years, platforms had leverage because they controlled distribution. Google controlled search traffic. Amazon controlled product discovery. You paid them for access.

With shopping graphs, the leverage inverts—but only if you build first-party infrastructure. Platforms need high-quality, real-time, semantically rich product data to make agentic commerce work. They can’t deliver accurate agentic responses without it. If you control a complete shopping graph, you become a strategic data partner, not a commodity merchant feed.

This means you negotiate integration terms instead of accepting default platform extractions. You can choose which platforms get access to which data, with what freshness, under what commercial terms. You can even choose to make certain semantic attributes exclusive to your owned channels, using superior product discovery as a moat.

But this only works if your graph is comprehensive enough that platforms can’t easily replicate it through web scraping and automated extraction. Shallow graphs make you replaceable. Deep graphs make you essential.

The Retail Barbell Emerges

This transformation creates a barbell distribution in retail. On one end sit massive platforms like Amazon, Google, and OpenAI that can afford to build and maintain comprehensive shopping graphs covering millions of merchants, becoming the default agentic layer. On the other end sit sophisticated retailers who build first-party shopping graphs as strategic infrastructure, maintaining direct relationships with both consumers and AI agents.

The disappearing middle includes everyone else—retailers who assume “being online” means “being agentic-ready,” who treat structured data as an SEO checklist item, who wait for platforms to index them automatically. The middle doesn’t get squeezed. It gets deleted. Because in agentic commerce, if you’re not in the graph, you’re not in the query results. Period.

What This Means Right Now

If you’re a retail executive, here’s your six-month roadmap.

Audit Your Semantic Infrastructure. Map your current product data against shopping graph requirements, identify gaps in attributes, relationships, and real-time updates, and assess your Schema.org implementation. It’s not sufficient, but it’s a start.

Build Your Core Shopping Graph. Structure product knowledge with semantic relationships, implement real-time data sync, create API access layers for agent integration, and deploy comprehensive structured data markup. This is the foundation. Everything else builds on this.

Integrate with Agentic Platforms. Connect to Google Shopping Graph if accepting their terms, prepare for OpenAI and Shopify integrations, and build direct agent access APIs for emerging platforms. Don’t wait for platforms to extract your data poorly. Publish it properly.

Own Your Semantic Positioning. Define competitive semantic attributes that differentiate you, control product relationships and comparisons instead of letting platforms decide, and maintain first-party context that agents query. This is where you build defensibility.

This isn’t a marketing initiative. It’s infrastructure investment with infrastructure timelines and infrastructure ROI.

The Deeper Transformation

The unification of the funnel through agentic AI isn’t just about faster shopping. It’s about who controls the semantic layer between customer intent and product fulfillment.

For twenty years, that layer was Google’s search index—and we accepted it because we could still own the “last mile” through our websites, our checkout processes, and our customer relationships.

Now, agents are coming for the last mile too. Google’s agentic checkout literally completes the purchase on your behalf. The entire journey from question to transaction happens in Google’s interface, using Google’s shopping graph, with Google taking a cut.

Your shopping graph isn’t a defense against this. It’s your only leverage in the negotiation. Because platforms need high-quality, real-time product data to make agentic commerce work. The question is whether you’re a data supplier giving it away or a strategic partner maintaining control.